Simplify Financial Planning: Use Brands.live Loan Calculator Features

Equated Monthly Installment (EMI) signifies the sum payable to the financial institution where you’ve borrowed. Typically, loan agreements with banks or moneylenders outline these repayments.

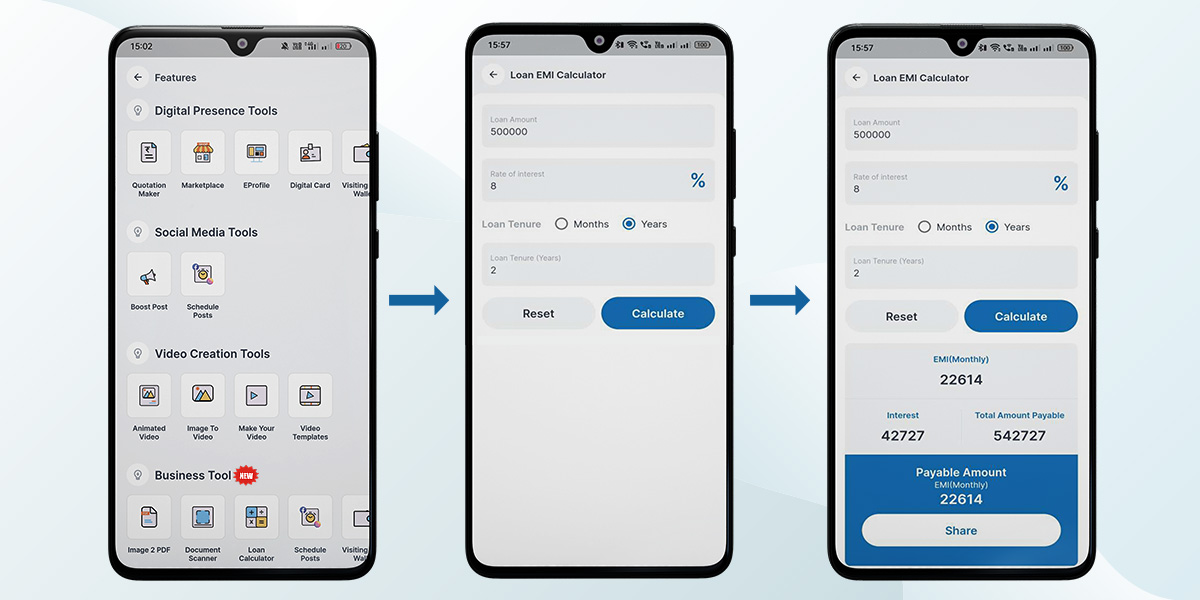

Brands.live’s New feature, the Loan EMI calculator, aids in budget planning. It provides clarity on your monthly obligations, aiding in financial management.

What is a Loan EMI Calculator?

A Loan EMI calculator, like a regular calculator, aids in calculations. However, it’s more complex because it helps compute your monthly loan payment.

• Begin by inputting the desired loan amount.

• Next, choose the interest rate for the loan.

• Lastly, select your preferred repayment period.

How Brands.live App Facilitates EMI Calculation:

EMI is the combined amount of the borrowed principal and interest, divided by the repayment duration in months. Therefore, the monthly EMI payment relies on both the borrowed amount and the repayment period.

Note: Please be aware that in the beginning stages of your EMI payments, the interest portion is higher but decreases gradually as you continue making payments in the subsequent months.

Here’s an example:

Person X borrows a personal loan amounting to INR 5 lakhs for a period of 2 years with an 8% interest rate.

The EMI will be determined as follows:

P = 5,00,000

R = 8%

N = 2 Years

Loan EMI Calculation: EMI = [P x R x (1+R)^N]/[(1+R)^N-1]

Loan EMI Calculation: EMI = [5,00,000 x 8 x (1+8)^2/[(1+8)^2-1]

Tool Results are Shown below:

| Loan EMI | Total Interest Payable |

Total Payment (Principal + Interest) |

| ₹22,614 | ₹42,727 | ₹5,42,727 |

How to Get Started with Brands.live:

If you’re ready to transform your Document into Scanner effortlessly, follow these simple steps:

1. Visit Brands.live.

2. Click “Custom.”

3. Select “Popular Features.”

4. Choose “Business Tool.”

5. Input loan details and calculate.

Note: Brands.live NEW Feature directly counts the above formula calculation and directly shows the EMI amount. Check the below image for a better understanding.

Benefits of Using Brands.live New “Loan EMI Calculator Tool”:

• Accurately calculates monthly loan expenses.

• Encourages saving for future goals.

• Assists in choosing the best lender and interest rates.

• Helps select a suitable tenure.

Conclusion:

To guarantee a safe loan process, understanding your total borrowing expenses is crucial. Employing an EMI Loan Calculator simplifies the intricate calculations, providing precise amounts. Additionally, being familiar with EMI and interest rate formulas keeps you informed about your financial transactions.

To resolve your financial concerns with intelligent solutions, Use our App Because Brands.live है तो सब आसान है! (Aasan Hai)

Frequently Asked Questions:

Certainly! The Business Loan EMI Calculator offered by Brands.live is exceptionally user-friendly. Its interface is designed to be simple and intuitive, ensuring effortless input of loan details and quick access to the desired results. Whether you’re an experienced borrower or new to business loans, Brands.live makes the process seamless and accessible for everyone.

Certainly! The Business Loan EMI Calculator is accessible online and can be utilized round the clock, 24/7 in the Brands.live app.

Indeed, the outcomes provided by the Business Loan EMI Calculator are reliable. Yet, it’s essential to recognize that these results are approximations and might slightly differ from actual figures due to factors like rounding off and the unique terms within the loan agreement.